What group benefits are small Canadian employers interested in providing for their employees? And what are their reasons and priorities behind this? We’ve compiled data from our Benefits Assessment Survey to bring you the answers to these questions. This data represents 1156 employers with 1-50 employees. Survey results were gathered from responses from August 2020 to October 2022.

Key Findings from the Benefits Assessment

- 88% of employers surveyed did not previously have a benefits plan.

- 96% of employers prioritize keeping the costs of their benefits plan reasonable.

- 92% of employers want to protect employees from high cost medical and drug expenses.

- Only 44% of employers are interested in building the wealth and security of their employees and their families, with just 17% of employers selecting GRRSP’s as a benefit option.

- 67% of employers want to encourage employees to do things that make them happy, yet only 36% selected to include a Wellness Spending Account.

- The top benefits that employers want to include in their benefits plans were Dental (92%), Health (91%) and Vision Care (81%)

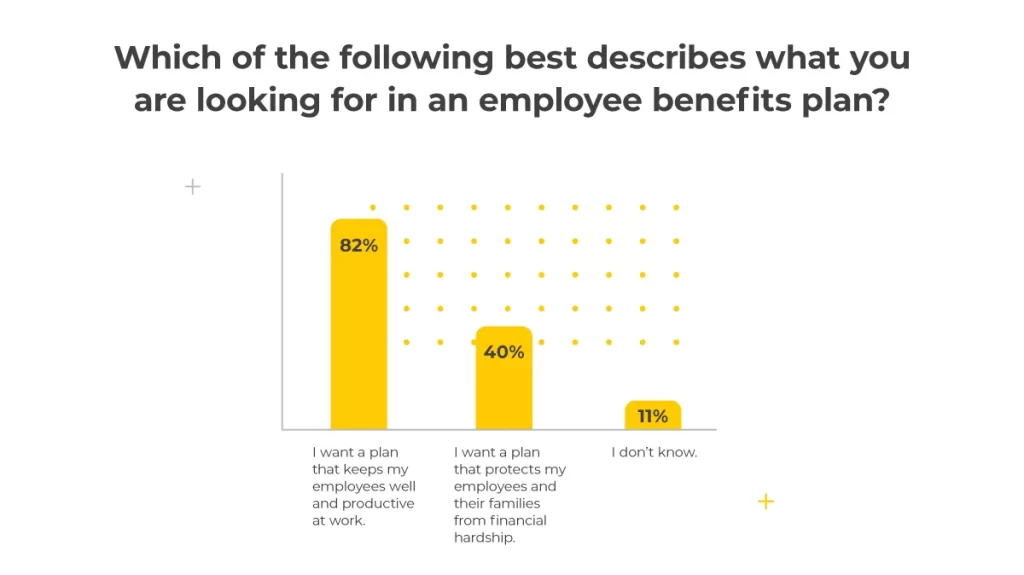

What Are Employers Looking to Achieve with Their Benefits Plan

Most employers want healthy, engaged employees. In fact, 82% agreed they want their benefits plan to help keep employees well and productive. Protecting employees and their families from financial hardship was a concern for 56%.

11% didn’t know at all, indicating that employers are looking for more information, and may have a lot of questions surrounding group benefits.

What Are Employers’ Priorities When It Comes to Their Benefits Plan

(*note: this adds up to more than 100% as employers could choose multiple answers.)

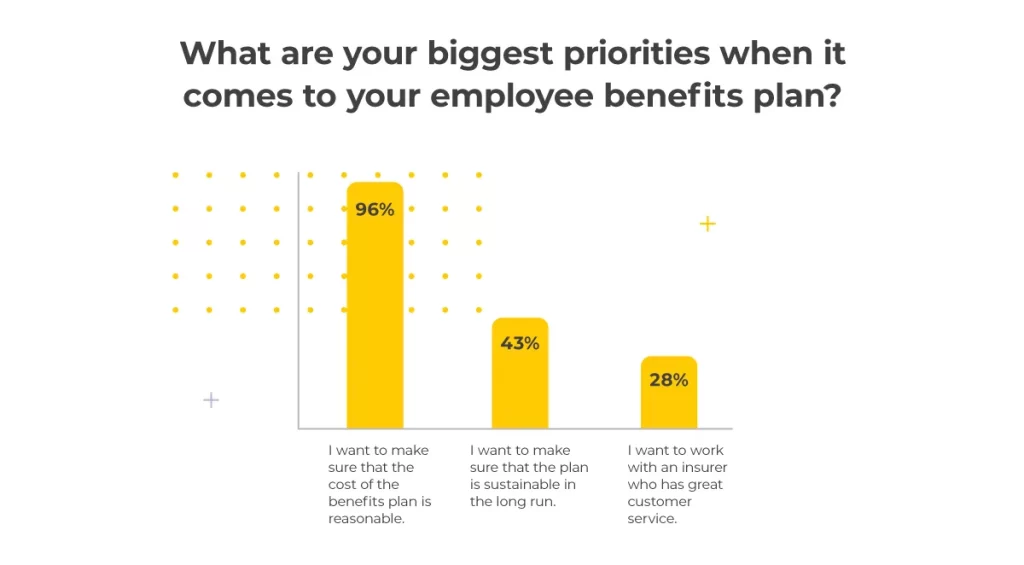

It comes as no surprise that keeping costs reasonable was the number one priority for employers. A whopping 96% chose this category. And with inflation still on the rise, we expect to see this trend continue.

Still, only 43% want to make sure that the plan is sustainable in the long run, which we found surprising given the fact that the 2nd biggest concern of employers in the 2022 Benefits Canada Healthcare Survey was the overall sustainability of their benefits plans.

Interestingly, only 28% prioritized working with an insurer who has great customer service. In the days of short attention spans and expectations for quick responses (live chat, anyone?) that this would be a concern. However, these numbers suggest that people are willing to put up with lower service standards in order to save money. Or maybe they just think they are!

Employer Ideals for the Health of Their Employees

We found that 92% of employers want to protect employees from high cost medical and drug expenses. A catastrophic hybrid plan would help employers achieve both reasonable costs, while still providing the protection they need.

Seventy-five percent were interested in giving employees access to preventative health coverage, such as physiotherapists, nutritionists, and speech therapists.

This number dropped to just 7% for employers where that was the only priority. Yet 64% chose paramedical services when asked what benefits they would include in their group benefits plan. Perhaps employers are not quite sure how their benefits plan goals equate to the benefits they should offer?

[Free Download] A Guide to Finding Your Employee Benefits Philosophy (bbd.ca)

Employer Ideals for the Wealth of Their Employees

Employers are still not wholly on board when it comes to helping employees financially. Twenty-three percent said they had no employee wealth benefits ideals.

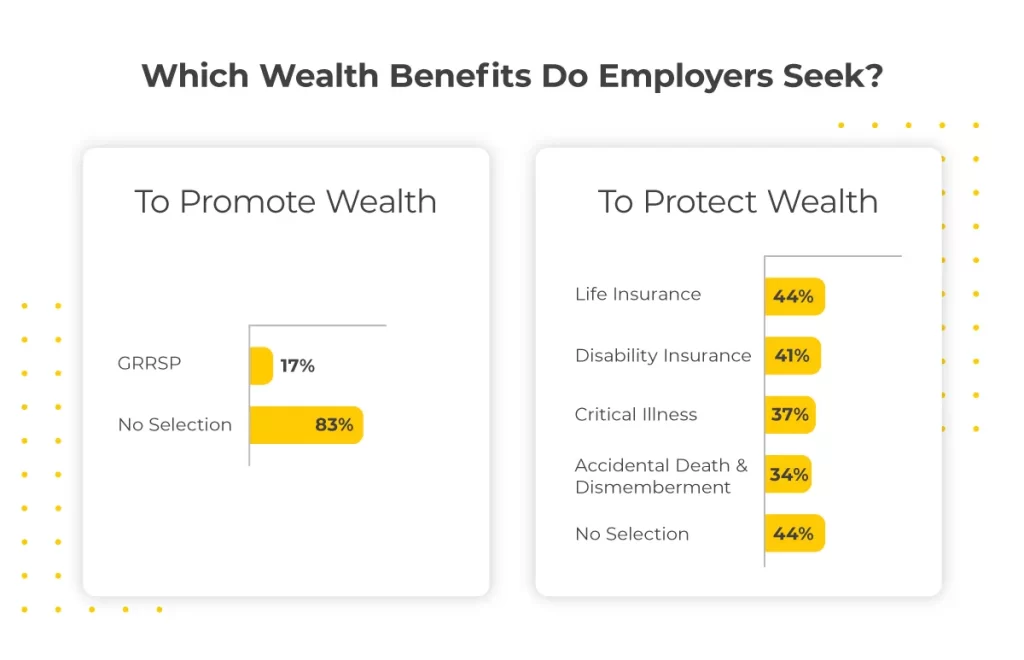

Only 44% were interested in building the wealth and security of their employees and families, which correlates with the fact that 44% made zero selections under the Wealth Protection Benefits category, and only 17% selected Group RRSP’s under the Wealth Promotion Benefits category.

Employers were much more concerned about keeping employees financially secure if they become unwell. Seventy-two percent wanted to provide financial support in the event an employee gets injured or sick. Benefits such as Accidental Death & Dismemberment (AD&D), Critical Illness (CI) and Disability Insurance can all help achieve this goal. However, when it came time to choose their benefits, only 34% of employers chose AD&D, 3% went with CI, and 41% picked Disability.

Employer Ideals for the Happiness of Their Employees

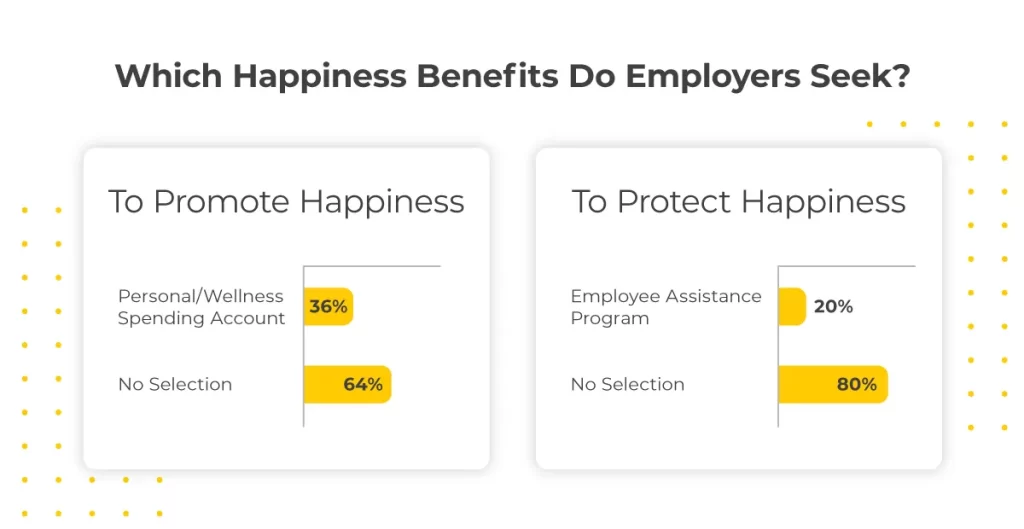

The majority of employers want to provide resources and support for employee mental health, with 72% selecting this option. Yet when it came to actual benefits that provide that support, only 20% chose an Employee Assistance Program, and as mentioned above, only 64% selected paramedical coverage. Psychologists, social workers and clinical counsellors all fall under this category. Once again, is it a matter of education? Perhaps employers aren’t sure “how” to provide support, they just know that they want to.

Two thirds of employers (67%) were interested in encouraging employees to do things that make them happy, yet only a third (36%) selected to include a Wellness Spending Account, which is the easiest way to achieve this. Wellness accounts provide flexible, budgeted amounts to employees that they can use to facilitate lifestyle activities – in other words, they can do things that make them happy.

What Benefits Selections Did Employers Make?

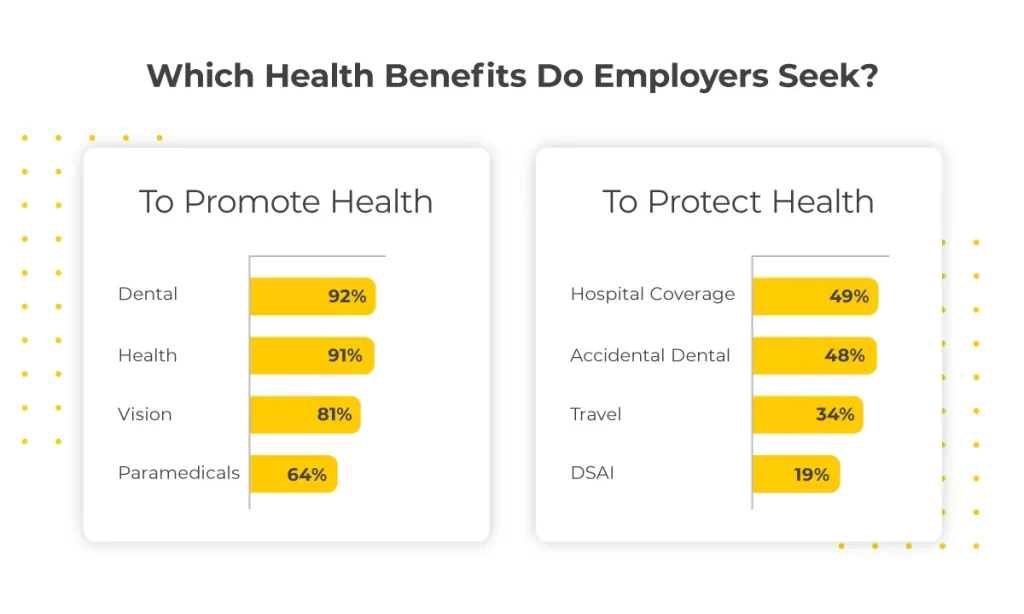

The top benefits that employers want to include in their benefits plans were Dental (92%), Health (91%) and Vision Care (81%). This doesn’t really surprise us, and is in line with our 2021 Benchmarking Report that shows 89% of groups have Health and Dental.

Life Insurance was only chosen 44% of the time, 48% wanted Accidental Dental, 49% selected Hospital Coverage, and 19% were interested in adding Diagnostic Specialist Access Insurance (DSAI). We found the DSAI percentage quite high, given the fact that only 1% of groups benchmarked currently have this benefit. Is it a sign that employers are seeing the effects of long wait times on their employees’ health?

We found that only 34% wanted to include travel coverage as part of their benefits selection. Could the global pandemic play a role in this? Or maybe employers aren’t aware that adding travel coverage under an Extended Health Benefit is quite inexpensive?

Conclusion

We noticed that employers with no previous benefits experience are curious about non-traditional insurance coverage. By selecting reasonable costs along with high-cost medical and drug protection, they were searching for Catastrophic Health coverage with a Health Care Spending Account (HCSA). And by choosing to keep costs reasonable as well as provide Health and Dental coverage, they were quite possibly searching for a Health Care Spending Account. They just didn’t know it yet!

Does Catastrophic Insurance Make Sense for My Employee Benefits Plan? (bbd.ca)

After reviewing the information, we believe that a lot of small business owners are not quite sure how to build an effective benefits plan that meets their goals. And for good reason! There is an extensive amount of knowledge and information that goes into creating and implementing a benefits plan. Which is where expertise from advisors and Third Party Administrators such as BBD is paramount to success.