10 Things to Know About Student Benefits Plans

By: Benefits by Design | Tuesday August 29, 2023

Updated : Friday September 1, 2023

A student benefits plan is exactly what it sounds like – a benefits plan for post-secondary students who are attending school either full- or part-time. Students’ benefits plan needs are different than employee needs. And they can often be misunderstood by an insurance industry that is focused on employee benefits. Let’s explore the differences and advantages for students of student benefits plans.

#1 – Student coverage through parental plans

There is the assumption that students are fully covered by their parents’ benefits plans. However, the coverage is only for extended health and dental care, and sometimes dependent life insurance. Which means that students are not covered for other pooled benefits, or important ancillary benefits which we’ll discuss below.

#2 – Parental and employee benefits eligibility

Parental coverage is only extended to full-time students who earn under a certain amount of money. And there is an age limit as well: most plans won’t cover students beyond the age of 25 or 26. Part-time students are not eligible for parental coverage. And students are often work part-time as well. However, they usually don’t work enough hours to be eligible for employee benefits either. Thus, a large portion of the student population isn’t covered by either parental benefits or employee benefits.

#3 – Different interests and needs

Student benefits plans focus on the needs and requirements of students. Which are different than employees’ needs. They aren’t trying to get back to work, they are trying to stay healthy so they can stay in school and study.

Between classes, work, assignments and studying, students have a lot on their plate. It’s no wonder the support and services they have access should be distinct.

#4 – Coordination of benefits

Students that are eligible for parental or employee coverage can coordinate it with student benefits to achieve fuller coverage. For example, if one plan pays 80% for prescription drugs, the other plan would cover the other 20%. If annual maximums are reached, the combined coverage can extend them.

Coordination of Benefits: Can I Have More Than One Benefit Plan?

#5 – Overall student health

Students are generally considered to be a healthy part of the population. And insurers take into account the claiming patterns of its plan members when pricing the rates. Healthy plan members (in this case, the students) generally claim less in medical expenses. As such, student benefits plans have a low cost – usually around $15-$20/month.

#6 – Economies of scale

This is another reason why student benefits are less expensive. When there is a large number of plan members that are paying premiums, especially if they are mostly healthy, it helps reduce the cost for everyone. Again, this provides for better rates than employee benefits are usually able to offer.

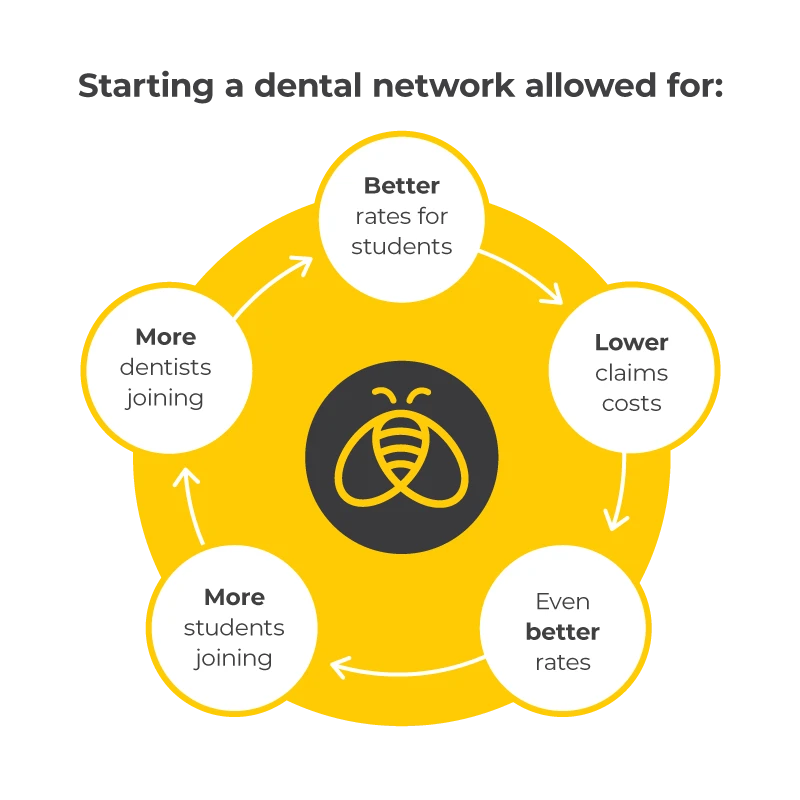

#7 – Dental networks

Some student benefits plans have dental networks that offer lower fees or discounts for students that are part of the plan. The image below shows how starting a student dental network is cyclical in its growth.

#8 – Travel insurance needs

Students have different travel coverage requirements than employees, whose travel insurance coverage usually caps at 30, 60, or 90 days of continuous travel. Student benefits include customized travel insurance coverage – for students studying abroad, or for exchanges and/or conferences. A standard one-year travel policy to the US could cost around $1,000. With student benefits plans, these travel needs are taken into account and the price is much lower for longer travel maximums.

#9 – Legal services and support specific to students

The challenges that students face can be different than those faced by employees. For example, they may need assistance with housing and tenancy laws, or academic disputes with their university or college.

Students are also susceptible to sexual advances and assault, and student benefits can provide extra care and help navigating the legal system if needed.

Lastly, international students have the added responsibility of ensuring they have their student visas and other immigration documentation in order.

Student benefits plans provide support for all of the above legal concerns.

#10 – Mental Health and Wellness Services

Eighty-nine percent of students “who face academic challenges say they affect their mental health.” The pandemic also affected students’ ability to form bonds and friendships in-person. These friendships can go a long way to helping students get through college or university in a mentally healthy manner.

A literature review by the Mental Health Commission of Canada reported 46% of Canadian students had above average stress and 15% had tremendous levels of stress. And “trans/gender-nonconforming and LGBTQIA+ students report higher levels of mental health challenges than their cis and straight peers.” Student benefits can offer mental health support and resources for everyone, as well as LGBTQIA+ specific support in the form of gender affirmation care.

Students may not have as much life experience and are therefore often taken advantage of. These services protect their interests and help them navigate the world independently.