2023 Benefits Canada Healthcare Survey results and learnings

By: Willow Munro | Tuesday September 26, 2023

Updated : Monday September 25, 2023

The 2023 Benefits Canada Healthcare Survey results are in, and the prevalent theme throughout was the fact that a person’s health does not exist in silos. A person does not have chronic pain, and then separately have a mental health issue. One issue can and often does stem from the other, and vice versa.

Mental health

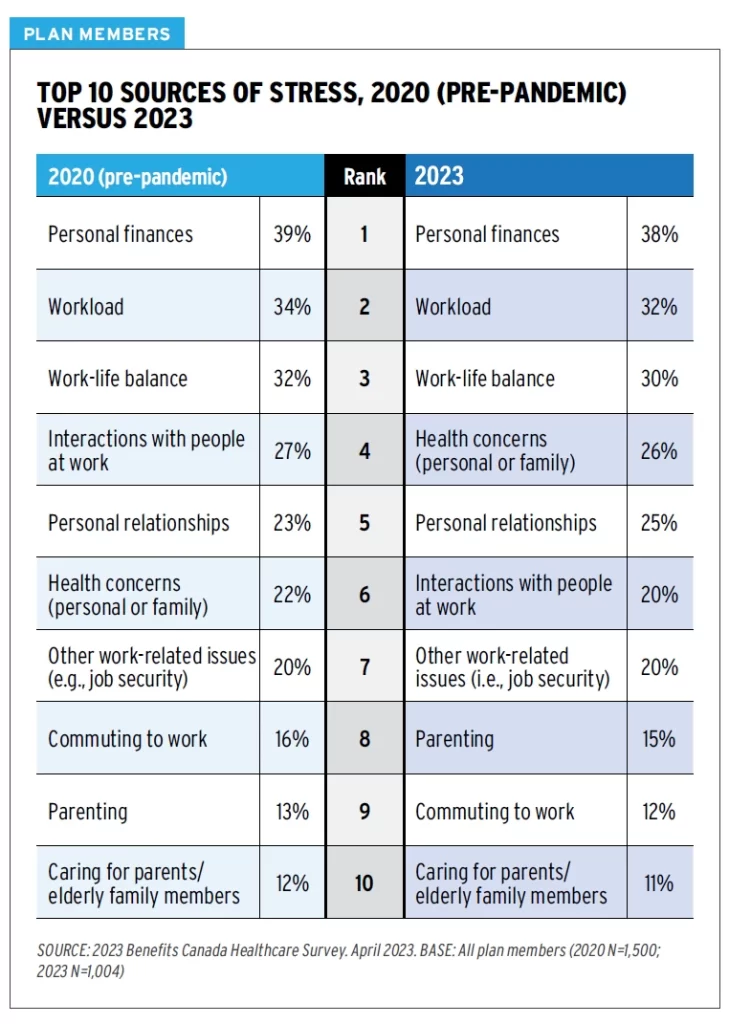

One of the bigger topics from the survey results this year was the fact that Canadians’ stress levels have not gone back to pre-pandemic levels. In fact, they are higher than ever before, with 38% of plan members reporting extreme or high levels of stress. Which means employees have a higher risk of developing mental health issues.

As expected, personal finances continue to be the top stressor for employees, with workload and work-life balance coming in second and third respectively. The following image shows the top ten sources of stress from both the 2020 and 2023 survey results.

Mental Illness Awareness and Overall Mental Health of Canadians

The connection between mental health and overall health

Eighty-nine percent of Canadian plan members surveyed say their overall health in the past year has been excellent, very good, or good.

The survey results also showed that 18% of plan members said their mental health is generally poor. However, that figure more than quadrupled to 74% for the 11% of plan members who also reported their overall health was poor.

Lastly, 63% of employees reporting poor overall health also reported high levels of stress. This suggests a strong correlation between overall health and mental health.

“Poor overall health may be a precursor to poor mental health and vice versa. The interplay between physical and mental health cannot be overstated” – Benefits Canada Healthcare Survey advisory board.

Drug Trends: The Use of Antidepressants – Cost and Prevalence

Chronic pain

Chronic pain was another topic of interest throughout the survey. It was tied for third among chronic conditions, of which 54% of plan members are currently diagnosed. The number of people reporting chronic pain also went up with age – going from 10% overall to 14% for those aged 55 and older.

Out of all the chronic conditions, chronic pain was found to have the most effect on a person’s overall and mental health. The survey found that a higher percentage of those with chronic pain had poor overall health (39%) and poor mental health (36%).

How Increasing Healthcare Wait Times in Canada Impact Health Outcomes

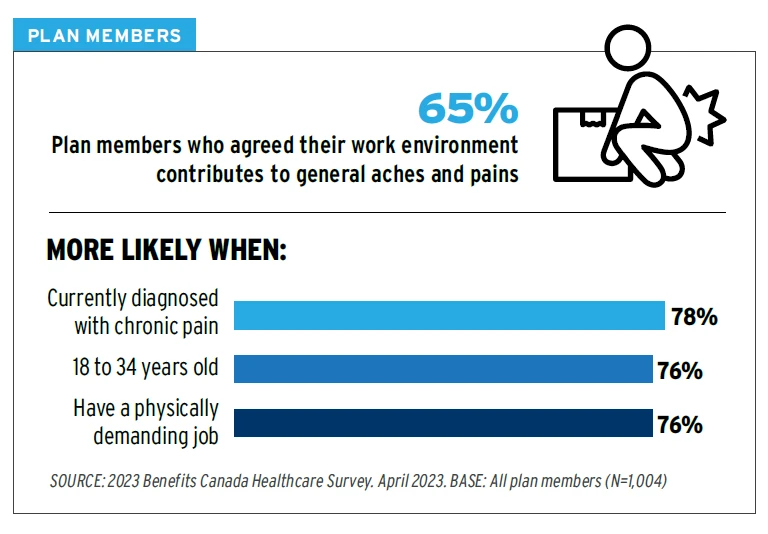

Finally, 65% of plan members agree that their work environment contributes to their general aches and pains. Unsurprisingly, that number was higher (76%) for those with a physically demanding job.

Remote and hybrid work may play a role in the increase in chronic pain. There is more difficulty with providing ergonomics oversight for remote workers.

Management and prevention of musculoskeletal conditions could go a long way towards helping employees combat their poor health. Plus, 33% of plan members with chronic pain reported it “makes it harder to get things done on a daily basis.”

Incidence rates for injuries that required rehabilitation were highest among younger plan members, proving the need for disability benefits and management at any age.

“This new data reinforces that chronic pain has a significant impact on employees and is closely associated with mental health. Chronic pain is one of the top five chronic conditions and a reliance on pharmaceutical treatment carries the risk of opioid use disorder. Put that together and we’ve really framed out a conversation about why supports for musculoskeletal health need to be a more deliberate part of health benefits plans.” – Brad Lepp, Canadian Chiropractic Association

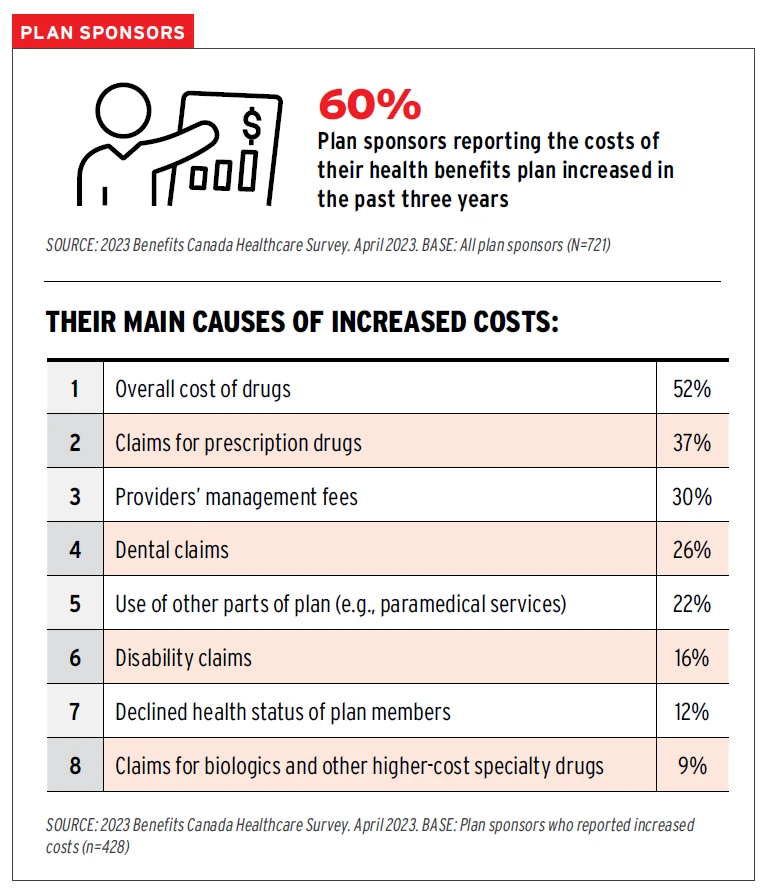

Cost concerns and coverage maximums

Employers are concerned about the impact of inflation on their benefits plans. Sixty percent of plan sponsors reported an increase in the overall cost of their benefits plans. The below image shows the main causes of increased costs:

Coverage maximums haven’t changed significantly in the last 10 to 20 years. Yet inflation (even without the large increase in 2023) has increased the cost for medical items and services across the board. And almost half of plan sponsors (49%) chose increased coverage levels to keep up with inflation as the most important option to improve their health benefits plan.

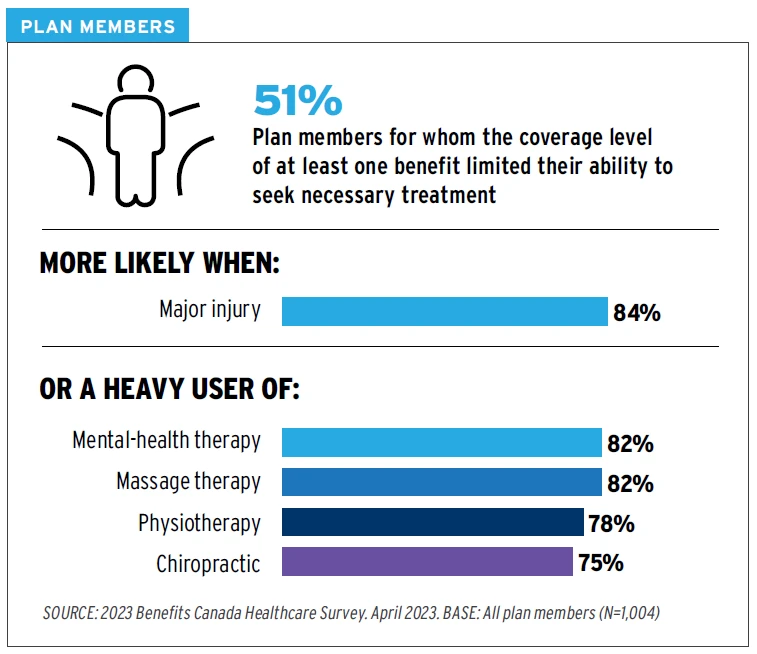

When asked what benefits did not meet their needs in terms of coverage levels, plan members indicated the following:

- Dental services – 25%

- Massage therapy – 19%

- Prescription drugs – 16%

- Mental-health therapy – 14%

- Physiotherapy – 13%

- Chiropractic – 9%

- Other paramedical services – 6%

More than half of plan members said that the coverage level for at least one benefit limited their ability to seek necessary treatment. Aside from mental health therapy, massage, physiotherapy and chiropractic use were found to fall short the most. This correlates with the need for more chronic pain support.

“These findings validate plan sponsors’ overarching concern that inflation is eroding the value of benefits Maximums.” – Benefits Canada Healthcare Survey advisory board.

Lastly, the survey results show that poor mental health is more likely when benefits plan does not meet plan member needs (44%), suggesting that insurers and plan sponsors need to continue adjusting coverage maximums if they want to continue supporting plan member health.

Understanding and navigation support

Employees need help navigating all the new tools and resources available. Providing a robust employee benefits plan with multiple tools, interfaces, websites, and ways to access services is all well and good for those that are familiar with the plan. The key is to get these tools and services into the hands of the plan members when they need them.

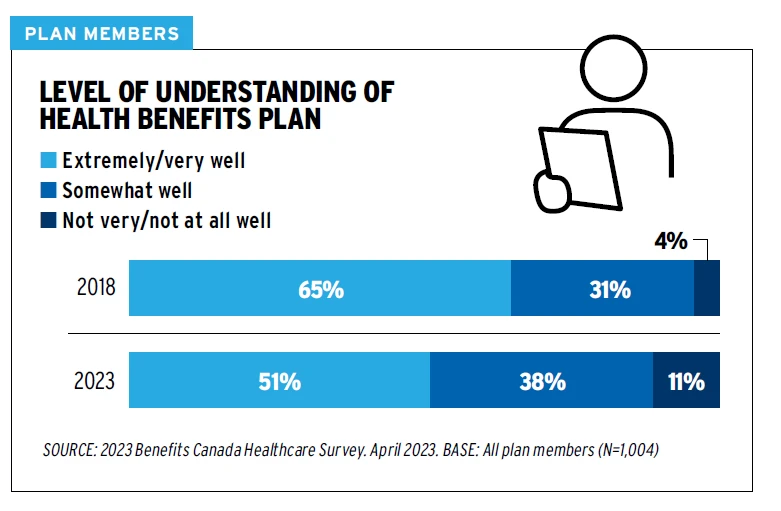

The survey results show that fewer plan members understand their benefits today than they did five years ago.

Communicating benefits in a unique, customized way will be key to educating plan members and increasing utilization. Direct, targeted communications to plan members using Artificial Intelligence (AI) could play a significant role in the future. In fact, plan members (28%) chose navigation services as their most desired new or lesser-known benefit.

Plan sponsors use email (50%) and the insurer’s website (38%) to do most of their benefits communication, but these methods are falling short of plan members’ needs. When asked, their top three ways for gaining information about their benefits plan were a website (32%), an app (17%) and a printed booklet (12%).

“The patient experience can feel compartmentalized because it’s challenging to navigate our complex health-care system. Employers focused on employee well-being can fill this gap by helping members understand all of the resources available, both through public health care and private group benefits plans to treat their condition. This is a growing expectation by employees and employers have an important role to play.” – Sunil Hirjee, Beneva

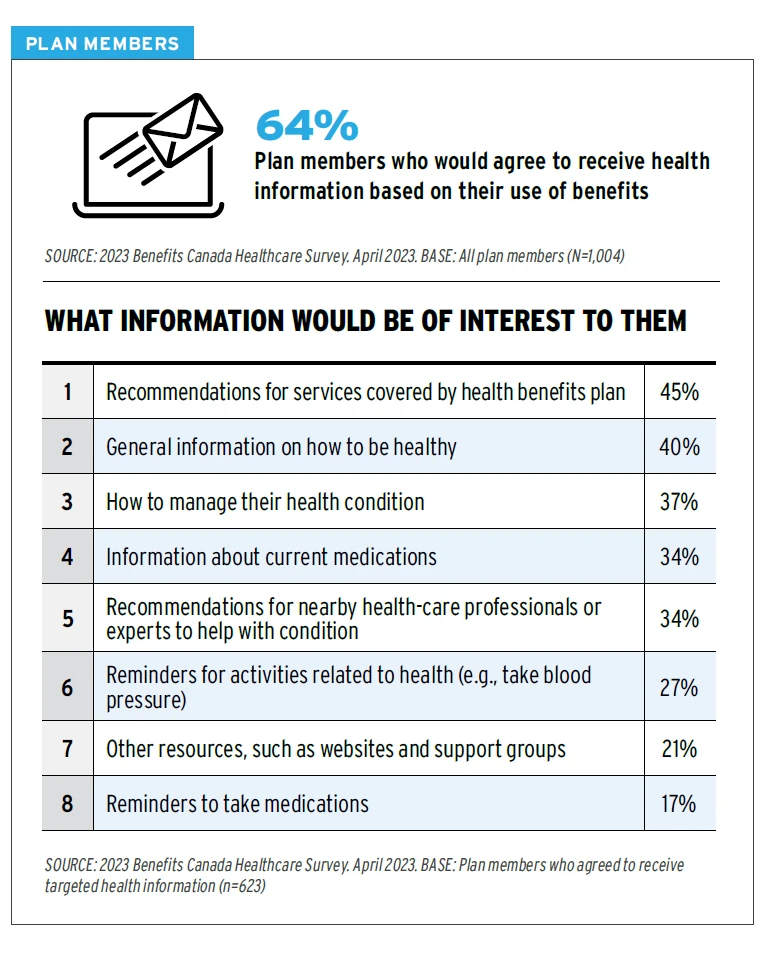

Personalized communications

The majority (64%) of plan members are interested in getting personalized information based on their plan utilization. This ties into their request for navigation support, as receiving information at time of need has an impact on whether an employee will digest the information that is presented.

The below image shows their top areas of information they would be interested in receiving:

Conclusion: Supporting the whole employee

The overarching theme the survey results are portraying is that all aspects of a person’s health can affect other aspects.

At Benefits by Design, we consider the four pillars of health – physical, mental, social and financial – to be equally important. By supporting the whole employee, you help create healthier, happier, and financially secure individuals that can in turn support your business.

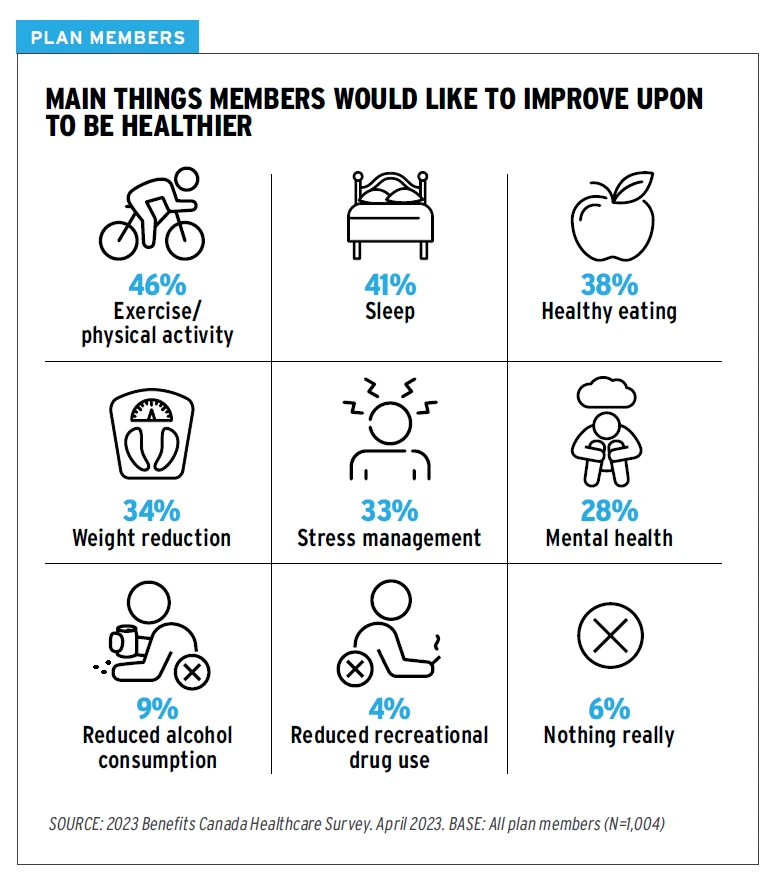

And it’s not just employers who are interested in healthier employees. Plan members themselves agree there are things they can do to improve their health. Exercise and physical activity topped the list at 46%, with sleep (41%), healthy eating (38%), weight reduction (34%), and stress management (33%) rounding out the top five.

When all is said and done, both employers and employees have a vested interest in preventing, maintaining and bettering their overall health.