What You Need to Submit Medical Claims Under a Group Insurance Plan

By: Benefits by Design | Tuesday February 15, 2022

Updated : Friday February 24, 2023

We know that insurance plans can seem overwhelming, particularly when it comes time to submit your medical claims. There are certain things that most Insurers will require in order to process a medical claim, and a few things you’ll want to keep in mind when utilizing your benefits coverage and submitting claims.

Let’s take a closer look at the criteria for submitting medical claims and explore some common reasons why claims might be declined.

What are Medical Claims?

For our purposes here, we’ll define a medical claim as when an employee submits an eligible medical expense to their benefits provider for reimbursement. This can include expenses ranging from prescription drugs and medical supplies to dental procedures and services, or paramedical services such as massage.

Always be sure to check your benefits coverage and confirm what is covered beforehand!

Group Health and Dental Insurance Specifics Every Employee Should Know

Submitting Medical Claims

This will vary depending on the type of claim and the Insurer’s processes. However, there are a few generally recommended items that most or all Insurers will require.

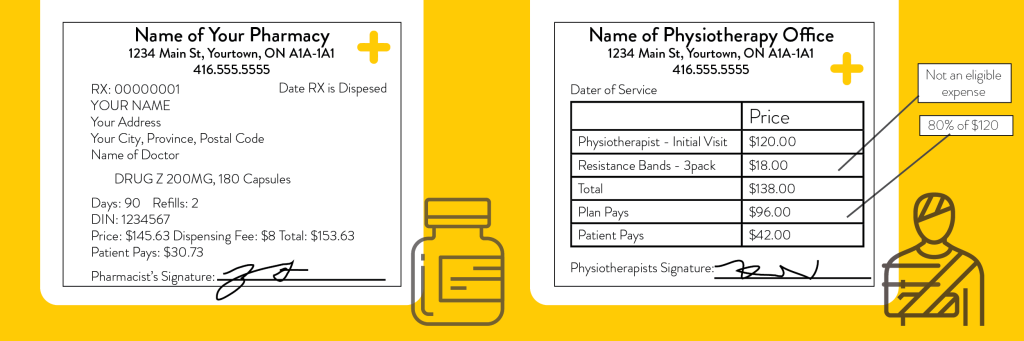

- Itemized receipt — you’ll want to include the itemized receipt alongside your claim. The Insurer will want to see the service or item that was provided to you (the eligible expense), who it was provided to (to confirm the plan member or dependent), and by whom offered the service (the service provider). Below are two examples of acceptable receipts.

- Proof of Payment — simply inputting the cost of the service will not be sufficient. In most cases, the Insurer reviewing the claim will need to be able to see the amount of the eligible expense, as well as confirm that it was paid by the employee. This is often in the form of an amount on the receipt that shows how much was paid and any balance owing, if any.

- Name of the Service Provider — the Insurer will need to confirm that the service provider is registered as an eligible provider. Different Insurers will have their own method of confirmation, and often require practitioners to register in order to be eligible.

Dental Claims and Automated Claims Submission

When it comes to dental claims, things generally work a bit differently.

For basic services, such as a cleanings, x-rays, or cavity fillings, dental claims are often submitted to the Insurer directly by the dental office. The reimbursement goes directly to them so the plan member does not have to pay the total up front, and then submit the claim themselves. If the group benefits plan has a co-pay, only that amount would be due to be paid by the plan member.

Not every dental office will have direct billing with your specific Insurer, so it’s best to confirm with the offices or the Insurer beforehand.

What is Dental Insurance, What is Covered, and Why Should You Want It?

For some of the Major, and all Orthodontic Services, a dental predetermination, outlining the procedure and the cost, must be submitted prior to the service being performed. This helps to keep the plan sustainable for all plan members. Dental pre-determinations may also have a time limit that the procedure must be performed within. Always check your plan design to confirm!

Reasonable and Customary Expenses

Reasonable and customary, sometimes known as usual and customary, is the average or standard price for a medical service. Most expenses provided by a paramedical practitioner, as well as certain medical supplies, will have a reasonable and customary valuation, similar to a dental fee guide.

Each insurer has their own list of reasonable and customary amounts, which means it is best to double check with your carrier if you would like to know the maximum for a specific service or item. Insurers will pay medical claims up to the reasonable and customary amount, with anything above being paid by the plan member. This practice aids with the overall stability of the plan over the long term.

How Dental Fee Guides Affect Reasonable and Customary Amounts

For example, if the reasonable and customary amount for a massage is $40.00, but a massage at an expensive, luxury spa is $120.00, an Insurer will cover the first $40.00, but the plan member will pick up the rest of the cost.

Special Authorizations

Certain drugs and medical items or supplies will require special authorization for the medical claim to be covered by the group insurance plan. Examples include but may not be limited to the following:

- High-Cost Specialty Drugs

- Biologics or Biosimilars

- Brand Name Drugs

- Narcotics

- Drugs being used for something other than their original intended purpose

- CPAP Machines

- Diabetic Supplies

Specifically with Brand Name drugs, and drugs being used for something other than their original intended purpose, plan members will be required to prove they have no other option. This means they and their doctor will need to complete a Government of Canada adverse effects form that shows the medical reasons the patient cannot take the usual course of drugs for their medical issue.

As different insurers may have different requirements, always confirm what documentation your specific carrier will require.

What Happens if my Claim is Denied?

When a claim is denied, the Insurer will provide an Explanation of Benefits (EOB), as with approved claims. This EOB will include the reason the claim was denied, and may provide direction for the plan member in terms of what they can do going forward. So, what do you do?

8 Common Mistakes People Make When Filing Group Insurance Claims

Re-confirm Your Coverage

The first thing to do is to check that your submitted claim is actually eligible under your plan. There are certain exclusions and limitations that it may have fallen under which could exclude it from being eligible for reimbursement. You can refer to your Benefits Booklet, or contact your Insurer directly.

Confirm All Information Was Sent

If the Insurer is missing any information or criteria, they will not be able to approve the claim because it cannot be processed.

Confirm your maximum(s)

Some plans may have a maximum amount that can be claimed for certain categories. Some are set annually, as with paramedical services, while others have a frequency limit and maximum. For example, BBD’s Green Shield Canada (GSC) Extended Health Plan offers $700 every 5 years towards hearing aids. If the plan has already paid up to the maximum, no further reimbursement will be available.

Request an Exception

If the claim is still denied and the plan member feels strongly that their service or item should be covered, the last option is to request an exception. There needs to be sufficient evidence and reason presented as to why the Insurer should consider covering the claim. The underwriters will take all key factors into account to ensure the approval of an exception will not be a detriment to the benefits plan.

Just as rent, groceries and taxes are an inevitable part of life, so are medical expenses. Using the above information as a guide can help answer important questions regarding pre-claim criteria and post-claim reimbursement and denials.