The 2025 BBD Benchmarking Report — is your benefits plan competitive?

By: Benefits by Design | Tuesday October 14, 2025

Updated : Friday October 10, 2025

October is Small Business Month, which is the perfect time for Benefits by Design (BBD) to release our annual benchmarking report. Focusing on employee benefits trends, cost-sharing, and the impact of benefits on attracting and retaining talent, the report offers businesses insights into employee benefits packages.

What benefits are employers offering in 2025?

There was a definite shift in the number of employees offering life insurance and accidental death and dismemberment (AD&D) insurance. In 2024, 88% and 87% (respectively) of organizations included the coverage in their fully insured benefits plan. Both of those decreased by 8% in 2025. All other benefits remained basically unchanged, with very small increases in health care, dental care, and critical illness coverage.

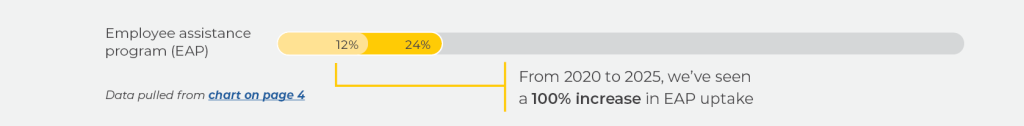

The benchmarking report also shows a continued increase in employee assistance program (EAP) uptake. This is a testament to employers’ commitment to employee well-being. In fact, over the last five years, we’ve seen the percentage of groups that choose to include the EAP double. Today, almost a quarter of companies with fully insured benefits under BBD have an EAP.

Another benefit being adopted more by employers is the health care spending account (HCSA). Our report also examined the number of overall groups we cover that have a HCSA, whether it was paired with fully insured benefits or not. We discovered that 43% of the companies we serve have a HCSA, about three times the number of those that pair it with fully insured benefits (15%).

How much of their earning are Canadians paying for benefits?

For the first time ever, we’ve added information about the amount employee benefits are costing Canadians. We’re happy to report that based on the average annual salary of an employee with fully insured benefits doesn’t have to break the bank to realize coverage.

According to Statistics Canada, the average annual salary in 2024 was $73,216 based on full-time employment at $35.20 per hour. Based on our own numbers, the average is $72, 450, while the average cost of premiums is $3,603. This equates to only 5% of an employee’s annual earnings.

This is great news for employees and employers alike, as some studies have shown benefits cost organizations between 15% to 30% of their annual payroll.

The Cost of Employee Benefits – Sustainable Plans vs Cheap Ones

Cost-sharing arrangements

This was the second time we’re reporting on cost-sharing arrangement percentages. In other words, how many employers are paying 100% of the premium, how many are paying half, and how many are making their employees foot the entire bill.

More than half of employers are paying everything when it comes to life insurance and other pooled benefits. In 2024, 66% of them also paid 100% for their health and dental premiums. However, this year we saw that drop down to 57%, which is likely due to the economic uncertainty plaguing Canadian businesses.

Interestingly, we noted that the number of organizations paying 100% of the premium for long-term disability (LTD) had increased. When employers pay the premium for LTD, the benefit claimants receive is taxable. Whereas if employees pay, then benefits received in the event of a claim are non-taxable. Still, 69% of employees are paying this premium, meaning they’ll receive the full amount of their benefit.

Conclusion

According to the 2025 Benchmarking Report:

- Staple benefits include health care, dental care, life insurance, AD&D.

- If you’re looking for a more robust plan, include dependent life, LTD and critical illness

- EAPs are growing in popularity, and many employees are looking for employers who offer this as part of a well-being program

- Spending accounts add flexibility to your benefits plan – something which 43% of our customers have already discovered

- Employers are paying the majority of the premiums for benefits, with the exception of LTD premiums

- At 5% of earnings, employee benefits are well worth the cost, especially considering their effectiveness on employee attraction and retention

Having a competitive benefits plan will help you retain and attract employees. Crafting the best plan possible for your organization means using tools like the benchmarking report along with employee feedback and industry knowledge.

![[FREE DOWNLOAD] Group insurance Quick Tax Facts Guide for 2026](https://www.bbd.ca/wp-content/uploads/2026/02/Group-insurance-Quick-Tax-Facts-Guide-for-2026-Banner.webp)

![The 2026 Health and Wellness Roadmap: build your employee well-being strategy [Free Download]](https://www.bbd.ca/wp-content/uploads/2026/01/HW-Roadmap-2026-Banner.webp)