Group Benefits Pooling Explained [FREE Infosheet and Infographic Downloads]

By: Benefits by Design | Tuesday November 22, 2022

Updated : Tuesday September 10, 2024

How is it possible to offer all these great employee benefits when you only have four employees? With group benefits pooling, the impossible is easy to achieve.

What is Group Benefits Pooling and How Does it Work?

Group Benefits pooling is a way of spreading risk amongst a large group in order to lessen the impact should the “event” that is being covered occur. For example, with Accidental Death & Dismemberment (AD&D), one of the risks is that an employee might get in an accident and become paralyzed. The insurance is there in case this were to happen, but the likelihood is very small that it ever will.

Thus, employers pay insurers monthly premiums to take on that risk and then the insurer, and not the employer, is responsible for paying any claims that arise.

When a claim is made from a very large group benefits pool, the effect is hardly felt. This allows insurers to provide lower rates. And allows them to ensure rate stability for their clients. If the risk was not spread out, employers would have to pay much more for their group benefits.

Why Focusing on Employee Benefits Sustainability is Your Best Shot at Success

Types of Group Benefits Pooling

There are several different types of group benefits pooling. While they all aim to achieve the same goals of lower rates and rate stability, they work slightly differently.

Insurance Pooling – How Canadian insurers handle claims above the pooling threshold

Pooled Benefits

Insurance costs for high-cost but low frequency (low risk) claims would be extremely expensive if insurers did not pool them. Unless you are a very large company. The following benefits are usually pooled:

- Life Insurance

- Accidental Death & Dismemberment (AD&D)

- Disability Insurance

- Critical Illness Insurance (CI)

By grouping these coverages into a pool, it allows small- and medium-sized companies to provide coverage for these high-cost claims without paying extremely high premiums.

Our infographic below explains this in further detail.

Health and Dental Pooling

When it comes to Extended Health Care (EHC) and Dental coverage, fully pooled plans are available as well. This is done for small groups in order to provide rate stability.

As with pooled benefits, all the groups are put in a “pool” together with other small groups. All claims experiences for all the groups goes into the pool. Similar to pooled benefits, except that the claims are more frequent and cost less, so the risk is lower. By spreading the claims experience amongst a larger number of plans, the rates do not fluctuate as much. So, if you have good claims experience one year, and then bad claims experience the next, the rates would remain stable.

The caveat is that employers are not privy to what types of benefits are being utilized by their employees. Therefore, it is difficult to make educated, effective plan design updates. If you don’t know what parts of the plan employees are using, how do you know if the plan is valuable?

Andrea Shandro – Group Benefits Expert, Advocate, Collaborative Partner and CoFounder of Vital Partners gives a great example:

“A company had never offered paramedical services like massage therapy, physiotherapy or chiropractic care. When they left their pool, the most utilized drug classification was muscle relaxants and pain killers. They found that by introducing paramedical coverage into the plan, employees became less reliant on pharmaceutical pain management.”

Stop-Loss Pooling

This is a type of group benefits pooling at the plan member level. Under the EHC benefit, each individual has a stop-loss threshold, commonly $10,000. When any individuals’ total claims reach that threshold, any amounts above are not included in the groups’ claims experience. Instead, the insurer takes on paying for those claims.

For example, Trikafta is a newer, highly effective drug used to treat Cystic Fibrosis and it has an annual cost of approximately $300,000 per year. If this claim were to be added to a small group’s claims experience, the premiums would be unreasonable and unsustainable.

This in turn helps keep plans sustainable by removing high-cost claims from the claims experience. An example would be maintenance drugs for chronic conditions such as diabetes or crones’ disease. Stop-loss is paid as a percentage of the total premium for the EHC benefit.

For a more detailed explanation of how stop loss works, refer to our blog post:

What is Stop Loss and How Does It Keep Benefits Plans Sustainable?

Pooled Benefits In Action:

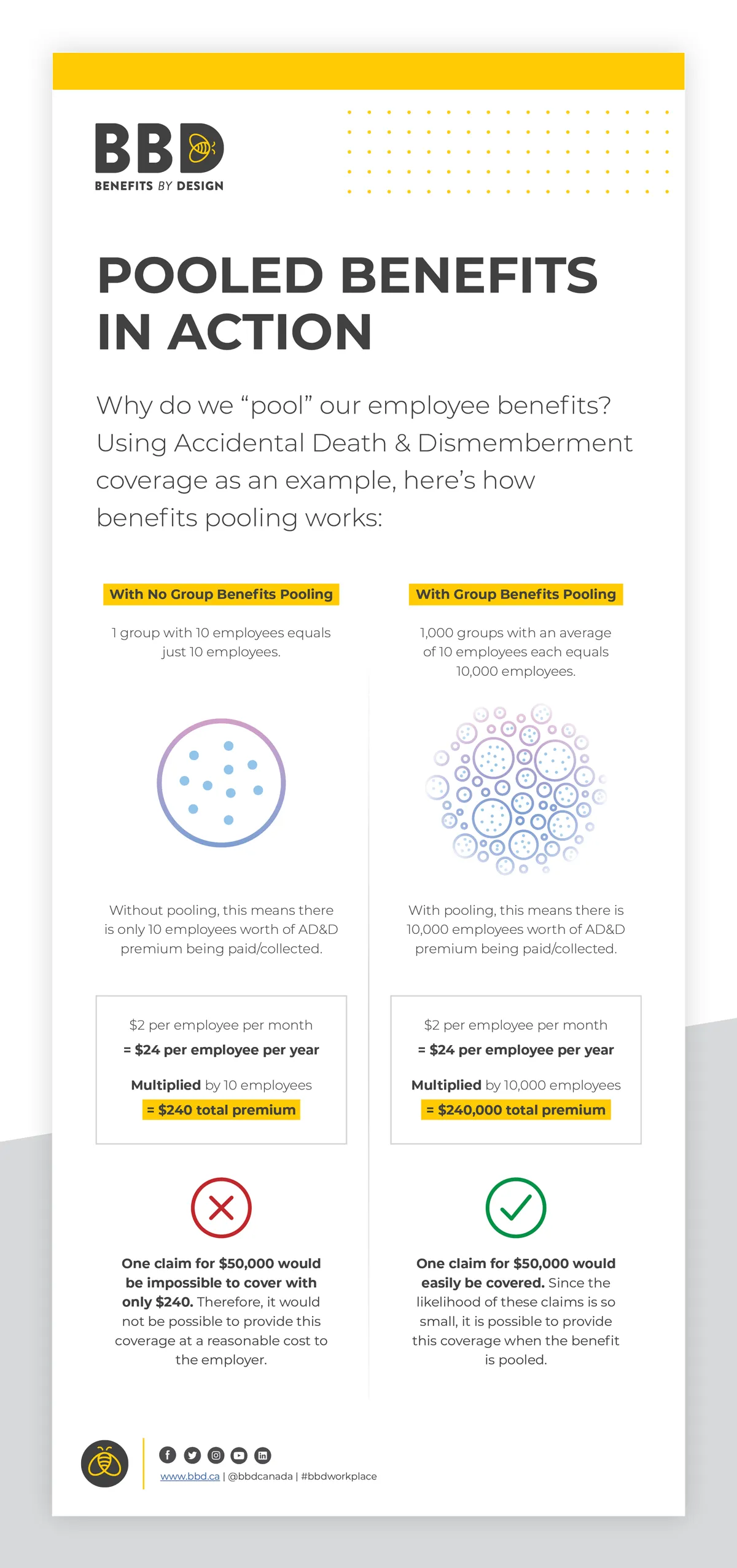

Why do we “pool” our employee benefits? Using Accidental Death & Dismemberment coverage as an example, here’s how benefits pooling works:

With No Group Benefits Pooling

1 group with 10 employees equals just 10 employees.

Without pooling, this means there is only 10 employees worth of AD&D premium being paid/collected.

$2 per employee per month = $24 per employee per year. Multiplied by 10 employees = $240 total premium.

Conclusion:

One claim for $50,000 would be impossible to cover with only $240. Therefore, it would not be possible to provide this coverage at a reasonable cost to the employer.

With Group Benefits Pooling

1,000 groups with an average of 10 employees each equals 10,000 employees.

With pooling, this means there is 10,000 employees worth of AD&D premium being paid/collected.

$2 per employee per month = $24 per employee per year. Multiplied by 10,000 employees = $240,000 total premium.

Conclusion:

One claim for $50,000 would easily be covered. Since the likelihood of these claims is so small, it is possible to provide this coverage when the benefit is pooled.

Download the Infographic: Group Benefits Pooling In Action (PDF: 351KB)

Group benefits pooling is really the heart of group insurance for small- and medium-sized businesses. Pooling is what allows insurers to offer insurance at reasonable rates so that employers are able to provide coverage for their employees. And since “losses are shared equally with a pool (group) of many others”, the risk is manageable.